Necessary Insights on Offshore Count On Possession Defense Solutions for Investors

When it comes to securing your riches, offshore trusts can be an essential solution. What details aspects should you think about to guarantee your overseas depend on serves your passions successfully?

Comprehending Offshore Trusts: A Comprehensive Review

When thinking about asset defense, comprehending offshore trust funds is vital. Offshore trusts are lawful entities developed in jurisdictions outside your home nation, developed to safeguard your properties from potential threats. You can produce these counts on for different factors, such as personal privacy, wide range monitoring, and, most notably, security versus lenders and legal cases.

Typically, you assign a trustee to manage the depend on, ensuring that your possessions are handled according to your desires. This splitting up between you and the possessions helps protect them from lawful vulnerabilities and prospective financial institutions.

While establishing an offshore trust fund may include first costs and complexity, it can give comfort understanding your wide range is safe. You'll want to completely investigate various territories, as each has its own policies and tax obligation effects. Understanding these nuances will certainly encourage you to make informed decisions regarding your possession defense strategy.

Key Benefits of Offshore Depend On Property Protection

When you think about overseas depend on property defense, you reveal significant benefits like improved privacy procedures and tax obligation optimization strategies. These advantages not only protect your riches however additionally give you with better control over your financial future. offshore trusts asset protection. Comprehending these crucial advantages can aid you make educated choices about your properties

Boosted Personal Privacy Procedures

Although you may currently recognize the monetary advantages of offshore counts on, one of their most compelling features is the enhanced personal privacy they supply. By positioning your properties in an overseas depend on, you protect your riches from public scrutiny and potential creditors. This degree of privacy is particularly important in today's world, where privacy is increasingly in jeopardy.

You can choose jurisdictions with rigorous personal privacy legislations, guaranteeing your monetary affairs remain discreet. Offshore trust funds can additionally assist you separate individual and business properties, additionally shielding your identity and rate of interests. This privacy not just safeguards your assets but also gives comfort, allowing you to focus on your investments without the anxiousness of unwanted attention or disturbance.

Tax Obligation Optimization Strategies

Lawful Frameworks Governing Offshore Trust Funds

Understanding the lawful structures controling overseas trust funds is essential for anyone contemplating this asset defense approach. offshore trusts asset protection. These structures differ substantially throughout jurisdictions, so it is very important to familiarize yourself with the regulations and requirements in your picked area. A lot of offshore counts on operate under the laws of specific nations, usually made to supply desirable problems for property security, privacy, and tax effectiveness

You'll need to examine elements like trust fund registration, trustee duties, and recipient rights. Compliance with worldwide laws, such as anti-money laundering laws, is likewise vital to avoid lawful problems. Additionally, some territories have particular regulations pertaining to the credibility and enforceability of trusts, which can influence your overall approach.

Selecting the Right Territory for Your Offshore Count On

How do you choose the ideal jurisdiction for your overseas trust? Initially, consider the legal structure. Try to find countries with robust property protection regulations that align with your objectives. You'll additionally wish to review the political and economic stability of the territory; a stable atmosphere lowers risks to your possessions.

Following, assess tax obligation implications. Some jurisdictions supply tax benefits, while others might impose high tax obligations on trust earnings. Pick a location that optimizes your tax performance.

A well-regarded place can improve the integrity of your depend on and give tranquility of mind. Having trusted lawful and monetary consultants can make a considerable difference in managing your trust fund properly.

Usual Kinds Of Offshore Trusts and Their Uses

When considering overseas trust funds, you'll come across different types that offer various objectives. Revocable and irreversible depends on each offer distinct benefits regarding adaptability and property security. Additionally, asset defense depends on and charitable remainder trust funds can aid you secure your riches while supporting reasons you appreciate.

Revocable vs. Irreversible Trusts

While both revocable and irrevocable trusts serve crucial functions in overseas property defense, they operate quite in different ways based on your objectives. A revocable count on enables you to maintain control over the properties during your lifetime, letting you make modifications or revoke it entirely. This versatility is excellent if you want access to your properties, however it does not supply strong security from creditors given that you're still taken into consideration the owner.

On the other hand, an irreversible count on transfers ownership of the assets far from you, providing a stronger shield against financial institutions and lawful insurance claims. Once established, you can not easily alter or withdraw it, however this durability can enhance your asset protection approach. Selecting the right kind relies on your certain requirements and lasting goals.

Property Protection Counts On

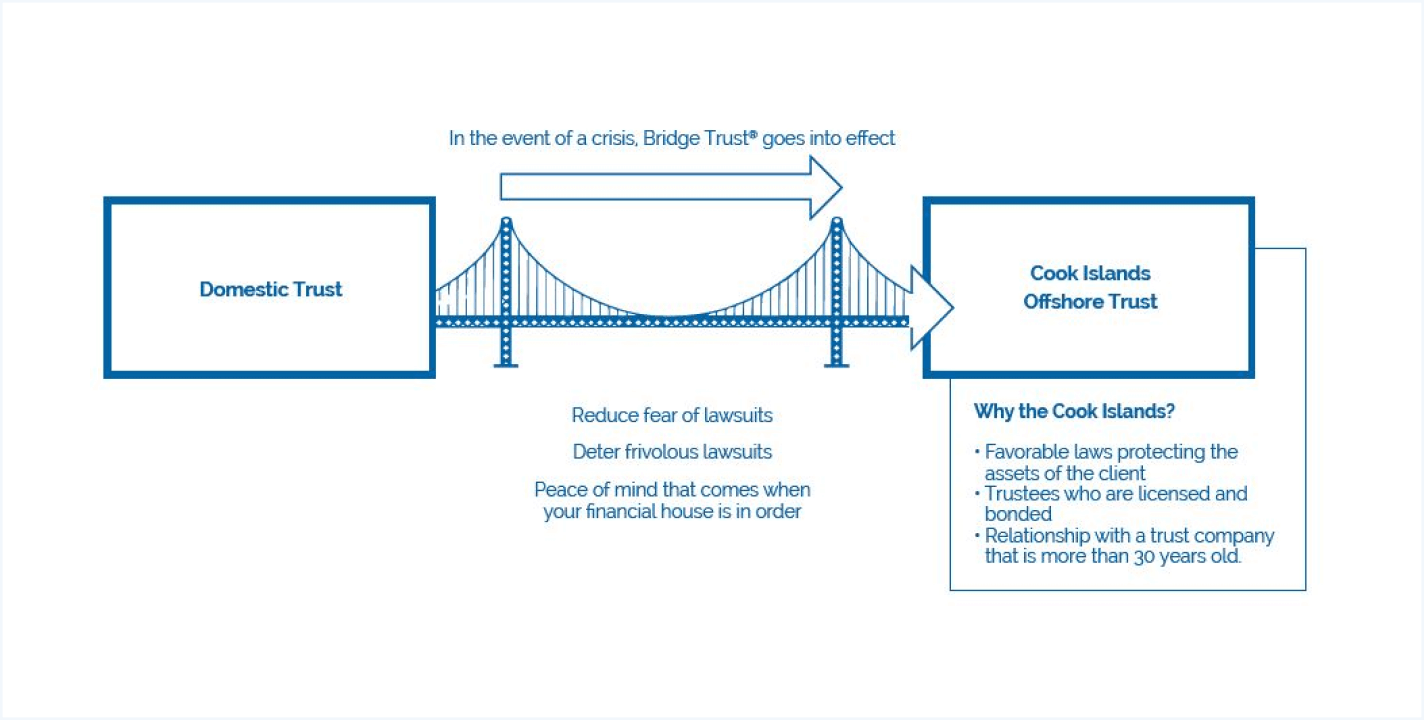

Property defense trusts are necessary devices for safeguarding your wide range from potential lenders and lawful insurance claims. One usual kind is the Domestic Possession Security Trust Fund (DAPT), which permits you to maintain some control while shielding possessions from financial institutions. Another alternative is the Offshore Asset Protection Count on, commonly set up in jurisdictions with strong personal privacy laws, giving better defense versus lawsuits and lenders.

Charitable Rest Trusts

Philanthropic Rest Depends On (CRTs) supply an one-of-a-kind method to accomplish both philanthropic goals and economic advantages. By developing a CRT, you can give away assets to a charity while maintaining revenue from those assets for a specified duration. This approach not just sustains a philanthropic cause yet additionally supplies you with a possible income tax obligation reduction and assists decrease your taxed estate.

You can choose to obtain income for a set term or for your lifetime, after which the staying possessions most likely to the assigned charity. This double advantage permits you to enjoy economic versatility while leaving a lasting impact. If you're seeking to balance philanthropic objectives with personal economic demands, a CRT could be an ideal solution for you.

Prospective Risks and Threats of Offshore Trusts

Although offshore trust funds can use substantial benefits, they aren't without their prospective challenges and threats. You might face higher costs connected with establishing and preserving these depends on, which can eat into your returns. In addition, steering through complicated legal frameworks and tax regulations in different territories can be overwhelming. If you do not adhere to neighborhood legislations, you might subject yourself to lawful fines or asset seizure.

Finally, not all offshore territories are created equal; some may do not have robust defenses, leaving your properties Going Here prone to political or economic instability.

Actions to Set Up and Manage Your Offshore Trust

Setting up and handling your overseas count on requires mindful planning and implementation. Choose a trusted offshore jurisdiction that lines up with your objectives, considering elements like tax obligation benefits and legal securities. Next, pick a trusted trustee or trust fund company experienced in managing offshore trust funds. Afterwards, compose the count on deed, describing the terms, recipients, and properties included. It's essential to fund the trust fund correctly, transferring possessions while sticking to legal demands in both your home nation and the overseas jurisdiction.

Once established, routinely evaluation and update the trust fund to mirror any adjustments in your economic situation or family characteristics. Keep open communication with your trustee to ensure conformity and efficient monitoring. Consult with lawful and tax obligation professionals to browse any kind of complexities and stay notified see this concerning developing policies. By adhering to these steps, you can shield your assets and accomplish your monetary goals successfully.

Frequently Asked Questions

How Much Does Establishing an Offshore Trust Fund Typically Expense?

Establishing up an offshore depend on normally sets you back between $3,000 and $10,000. Factors like complexity, jurisdiction, and the copyright you choose can affect the complete expenditure, so it is critical to research your choices completely.

Can I Be the Trustee of My Very Own Offshore Count On?

Yes, you can be the trustee of your own offshore trust, yet it's commonly not suggested. Having an independent trustee can offer extra property protection and integrity, which could be beneficial for your monetary approach.

What Occurs to My Offshore Trust if I Relocate Countries?

If you relocate countries, your offshore trust fund's legal condition may change. You'll require to take into account the brand-new territory's regulations, which might influence tax obligation implications, reporting requirements, and possession defense. Consulting a lawful expert is vital.

Are Offshore Trusts Topic to U.S. Taxes?

Yes, offshore trust funds can be subject to U.S. tax obligations. If you're an U.S. taxpayer or the trust has united state assets, you'll require to report and perhaps pay tax obligations on the earnings created.

Exactly How Can I Accessibility Funds Kept In an Offshore Trust Fund?

To access funds in your overseas depend on, you'll generally require to follow the count on's distribution guidelines. Consult your trustee for certain procedures, and validate you understand any kind of tax obligation implications before making withdrawals.

Final thought

In final thought, overseas trust funds can be pop over to this site effective tools for securing your assets and securing your wealth. While there are risks included, the peace of mind and protection that come with a well-structured overseas trust commonly exceed the prospective disadvantages.